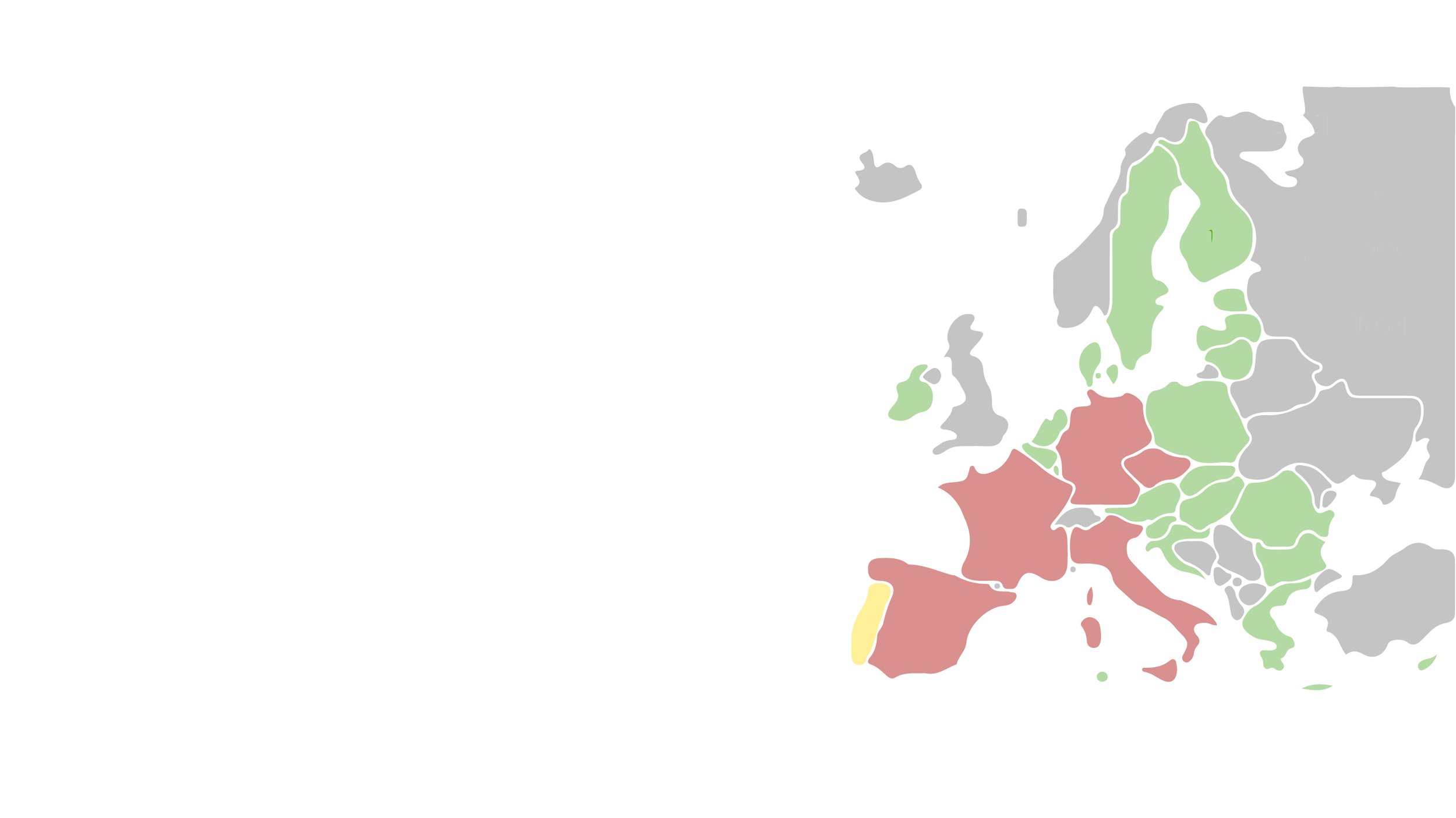

Brexit

Temporary Import Clearance

Into The EU

What Is Temporary Import?

Temporary Import refers to any kind of product that gets shipped over the EU border for one specific purpose and will then get sent straight back. This includes art pieces for an exhibition or sports gear. When temporary goods are shipped internationally, the import duties can be fully or partially suspended.

Austria

Belgium

Bulgaria

Are Temporary Imports Allowed?

Countries

Statements like “free of charge “, “no commercial value”, “value for customs purposes only” on a proforma invoice can only be used for repair & return under warranty, temporary import, etc.

Croatia

Temporary imports, invoice must clearly state: “temporary import for period...”

Cyprus

Czech

Republic

Customer must appoint 3rd party broker Consignee and Broker MUST make final clearance. If shipment is addressed to an international fair, the consignee can be charged for broker servicing at the fair. For shipments delivered under transit, a deposit equal to the customs debt may be taken until the consignee provides proof of final clearance. Non-standard clearance services such as: Clearance Authorization, Multiline Entry Clearance, Post-Clearance Modification, Bio/Phyto/Veterinary Controls, Bonded Storage, Bonded Transit Handover to broker, are provided at extra charge to be paid by the consignee.

Denmark

DTP only allowed for B2C shipments

Estonia

Additional delays may occur for temporary import

Finland

Temporary import/export shipments to/from FI are not recommended to be as DTP

France

Germany

Must be cleared by broker

Import clearance formalities on temporary basis, whether for exhibition purposes or inward processing, cannot be performed. Consignee must have appointed a broker to perform temporary formalities on his/her behalf. The third party broker name, address and contact name must be indicated in the consignee box of the HAWB. Third party broker’s charges must be paid by the csnee.

Temporary Import and Exhibition goods only via carnet or broker. Repair and Return only via broker. Shipment documents need to be issued in English or German with an accurate and concrete description of the goods (very general descriptions e.g. snacks or electronic goods are insufficient and result in delays in customs clearance!). RTO Deadline - Shipments will be returned within 18-19 days if no clearance is possible.

Must be cleared by broker

Greece

Hungary

Ireland

Italy

Temporary imports are cleared by third-party broker. Min 24 hrs delay. Inv must clearly state “Temporary Import”. Shipments destined to private addresses will suffer 24hrs delay. Cnee address must be indicated on inv even if it’s HFC shpmt. Shpts dest to foreign company attending exhibitions must be addr to the person attending the fair. (copy of passport required) Delays up to 48 hrs. Not possible to clear shipment in the name of a foreign company if IT VAT no not available.

must be cleared by broker

Latvia

Lithuania

Luxembourg

Malta

Netherlands

Temporary import: serial number or part numbers of the goods are required on the import invoice, Return to origin: in order to clear the goods without paying duties the former export DHL AWB has to be indicated on the import invoice.

Portugal

Temporary Imports & Exports for ESI or EPP products are NOT PERMITTED. All invoices for PT should be printed on the sellers letterhead paper. The invoice must contain: consignee details (name, address, contact name, phone no. and Consignee VAT Number), date, detailed & itemised description of contents, unit value (no “0” value accepted), total value, terms of trade (INCOTERM is optional) country of origin of the goods, seller’s signature and company stamp. To avoid delays it must NOT state “Value for customs purpose only”. No handwritten or correction type code are accepted. Sales shipments must come with a commercial invoice. Commercial invoices without company letterhead are not accepted. If the invoices does not include the freight amount, general price list it will be applicable for calculate customs charges.

Romania

Slovakia

Slovenia

Both the airway bill and invoice must clearly state the reason for temporary import (e.g. REPAIR, RMA, RETURN, RTO, etc) and original HAWB number (tracking number). Shipments returning to Slovenia as temporary imports are only released from Duty and VAT payment if under warranty and were also exported from Slovenia under warranty.

Spain

No courier clearance service available, unless the importer provides the courier with a registered bank guarantee.

must be cleared by broker

Sweden

Open a free account start saving money today

Why Join World Options?

Get access to exclusive quotes not available anywhere else

Compare prices from multiple carriers